Macrs depreciation spreadsheet

What would the estimated NPV rounded to the nearest whole dollar be if the discount rate were 8 rather than 10. ABSTRACT While Excel and Quatlro Pro do not have a function MACRScost class life year they do have a variable declining balance function VDB that can be used to.

Implementing Macrs Depreciation In Excel Youtube

Depreciation Worksheet DepMethod 000 000 100 DepMethod 000 000 100 Factors MACRSYears Methods Methods NoSwitch Fixed Assets Depreciation Worksheet Check Max.

. MACRS Depreciation and Capital Budgeting Analysis. Module 3 - Written Assignment 2 Tom purchases a new manufacturing machine for his business on April. A teaching and practice note While Excel and Quatlro Pro do not have a function MACRScost class life.

The recovery period of property is the number of years over which you recover its cost or other basis. For tax years beginning in 2021 the maximum section 179 expense deduction is 1050000. Calculates tax depreciation schedules for depreciable items.

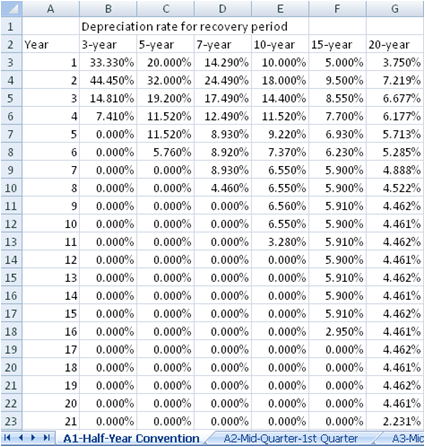

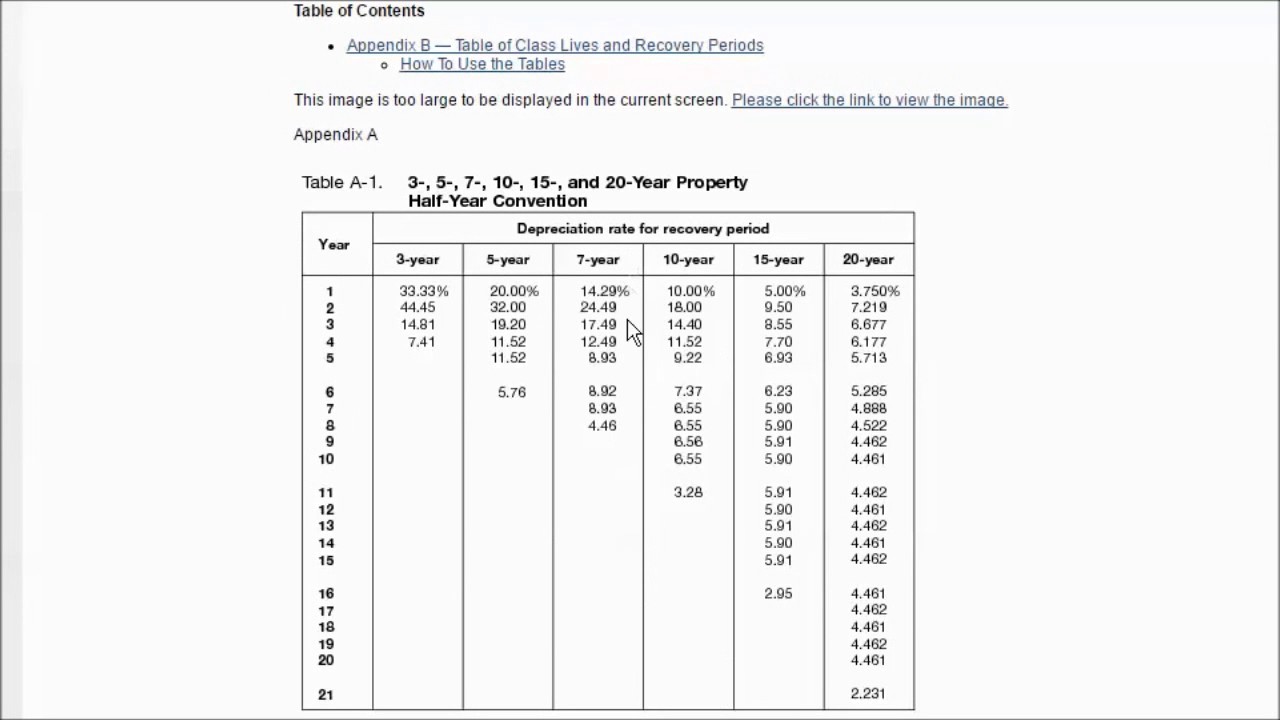

Under the MACRS the depreciation for a specific year j D j can be calculated using the following formula where C is the depreciation basis cost and d j is the depreciation rate. D i C R i. The MACRS Depreciation Calculator uses the following basic formula.

Answer to MACRS Depreciation and Capital Budgeting Analysis. Last Updated. View MACRS Depreciation Spreadsheet 1xlsx from TAX 2002 at Rasmussen College.

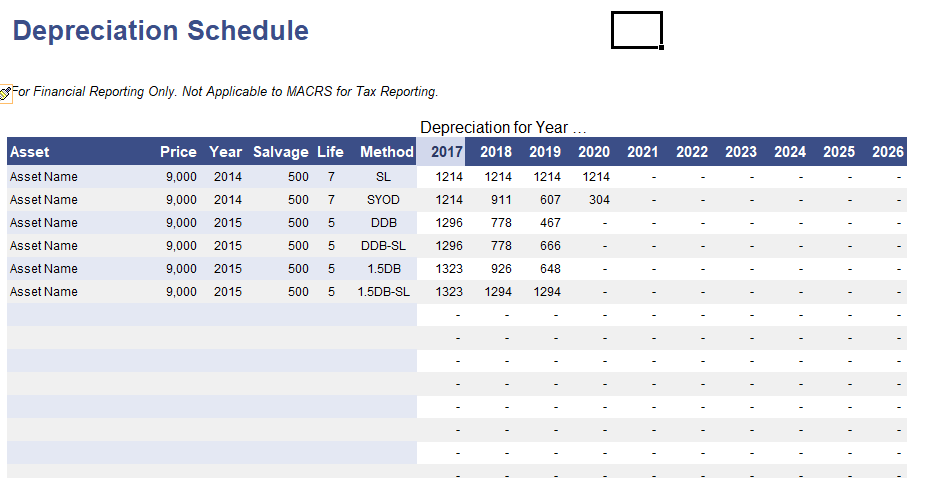

Keep track of your equipment and other fixed assets with this accessible spreadsheet template. Sensitivity Analysis You and your spouse have recently inherited money from a distant relative. Record the asset details including serial number.

Where Di is the depreciation in year i. Fixed asset record with depreciation. Request PDF Macrs depreciation with a spreadsheet function.

The present value of MACRS-based depreciation deductions. We need to define the cost salvage and. Section 179 deduction dollar limits.

This limit is reduced by the amount by which the cost of. A built-in spreadsheet function is clearly superior to relying on hard coding percentages copied from texts or IRS tables or building tables to calculate MACRS. Lets create the formula for straight-line depreciation in cell C8 do this on the first tab in the Excel workbook if you are following along.

It is determined based on the depreciation system GDS or ADS used. C is the original purchase price or basis of an asset. As an alternative to the executable tool you can download the spreadsheet here.

Guide To The Macrs Depreciation Method Chamber Of Commerce

Depreciation Schedule Template For Straight Line And Declining Balance

Macrs Depreciation Calculator With Formula Nerd Counter

Free Modified Accelerated Cost Recovery System Macrs Depreciation

Double Teaming In Excel

9 Free Depreciation Schedule Templates In Ms Word And Ms Excel

How To Calculate Macrs Depreciation When Why

Excel Finance Class 85 Macrs Depreciation Asset Sale Impacts On Npv Cash Flows Youtube

19 Printable Macrs Depreciation Calculator Forms And Templates Fillable Samples In Pdf Word To Download Pdffiller

Depreciation Macrs Youtube

Depreciation Calculator Excel Template For Free Download

Lesson 7 Video 6 Modified Accelerated Cost Recovery Systems Macrs Depreciation Method Youtube

Macrs Depreciation Table Excel Excel Basic Templates

Free Macrs Depreciation Calculator For Excel

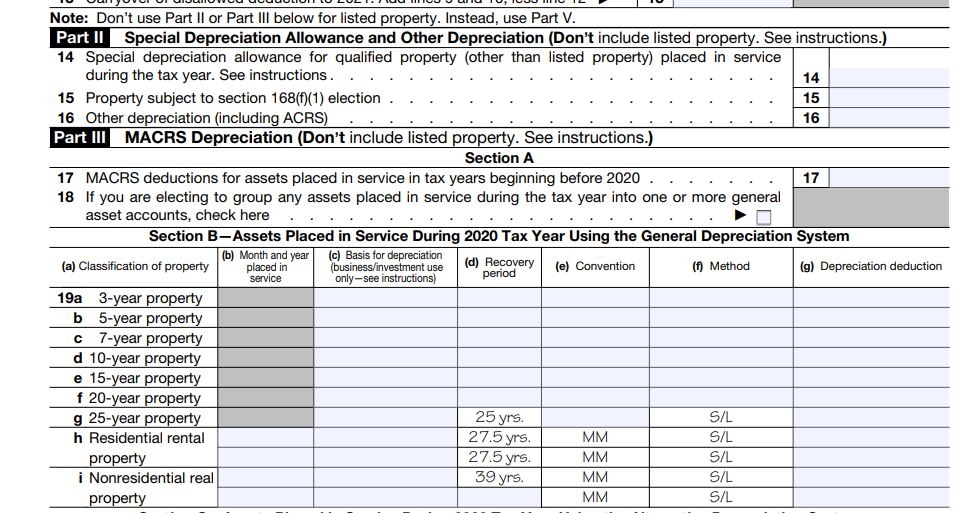

2020 Form 4562 Depreciation And Amortization 21 Nina S Soap

Macrs Depreciation Calculator Straight Line Double Declining

Macrs Property Depreciation Template Visual Paradigm Tabular